Take a walk into your stockroom. Go ahead, we’ll wait. See those boxes in the far corner, the ones covered in a thin layer of dust? That’s not just inventory. That’s frozen cash. It’s a constant, nagging reminder of a buying decision that didn’t quite pan out. Every retailer has them.

In fact, every independent retailer is in a constant battle with a two-headed dragon that lives in that stockroom. The first head is Dead Stock, the ghost of past mistakes that ties up your money. The second head is Slow Inventory Turnover, the thief of future opportunities that keeps your business from growing. These two problems work together to suffocate cash flow, clutter your showroom, and hold your business back.

This is your sword and shield. This guide is a complete, step-by-step playbook to slay this dragon for good. You will learn how to diagnose the health of your inventory, surgically remove the dead stock that’s draining your resources, and implement proactive strategies to create a lean, fast-moving, and incredibly profitable inventory system. Mastering your inventory is a foundational pillar of a thriving retail business, a core concept we introduce in our ultimate guide for independent lighting retailers.

Table of Contents

The Diagnosis – Understanding the Health of Your Inventory

Before you can treat an illness, you need a proper diagnosis. The same is true for your inventory. You need to stop relying on gut feelings and start using simple, powerful metrics to understand the true health of your stock.

What is Dead Stock, and Why is It So Toxic to a Retail Business?

Let’s be clear. Dead stock is any product that has not sold for an extended period, typically 12 months. It often starts as a “slow-mover” (a product with few or no sales in 3-6 months) and eventually graduates to full-blown dead stock. It happens for many reasons: a trend dies faster than expected, you ordered too much of a seasonal item, or you simply made a bad buying decision. We all do it. The danger is not in making the mistake, but in letting it linger.

The True Cost of Dead Stock: Beyond the Purchase Price

The real cost of a dead stock item isn’t what you paid for it; it’s what it costs you to keep it. This is the critical “aha!” moment for many retailers. Let’s break down the real annual cost of a single, unsold $100 light fixture.

| Cost Factor | Description | Estimated Annual Cost |

|---|---|---|

| Initial Purchase Price | The money you’ve already spent. | $100.00 |

| Cost of Capital (Opportunity Cost) | The return you could have earned by investing that cash elsewhere (e.g., in a bestseller). A conservative estimate is 8%. | $8.00 |

| Storage Cost | The value of the physical space it occupies in your stockroom. | $5.00 |

| Insurance & Taxes | You pay to insure your inventory, and it’s counted as an asset for tax purposes. | $2.00 |

| Total Annual Cost | The true cost to your business after one year. | $115.00+ |

That’s right. Your unsold $100 item is actively costing you an additional $15 or more every single year it sits on your shelf. It’s not just a stagnant asset; it’s a depreciating one that is actively draining money from your business.

What is Inventory Turnover, and How Do I Calculate It?

If dead stock is the illness, then inventory turnover is the vital sign that measures your health. It’s a simple number that tells you how efficiently you are converting your inventory into cash.

A Simple Definition: How Many Times You “Flip” Your Inventory

Think of it like this: If you started the year with an average of $20,000 worth of inventory in your store, and over the course of the year you sold a total of $80,000 worth of inventory (at cost), you effectively “turned” or “flipped” your entire inventory four times. The higher the number, the faster you are moving products and the more efficiently you are using your capital.

The Inventory Turnover Rate Formula, Simplified

The official formula sounds a bit technical, but it’s actually quite simple. You can get these numbers from your accountant or your point-of-sale system:

Cost of Goods Sold (COGS) / Average Inventory = Inventory Turnover Rate

For example, if your total COGS for the year was $100,000 and your average inventory value was $25,000, your turnover rate is 4.0. ($100,000 / $25,000 = 4).

What is a “Good” Inventory Turnover Rate for a Lighting Store?

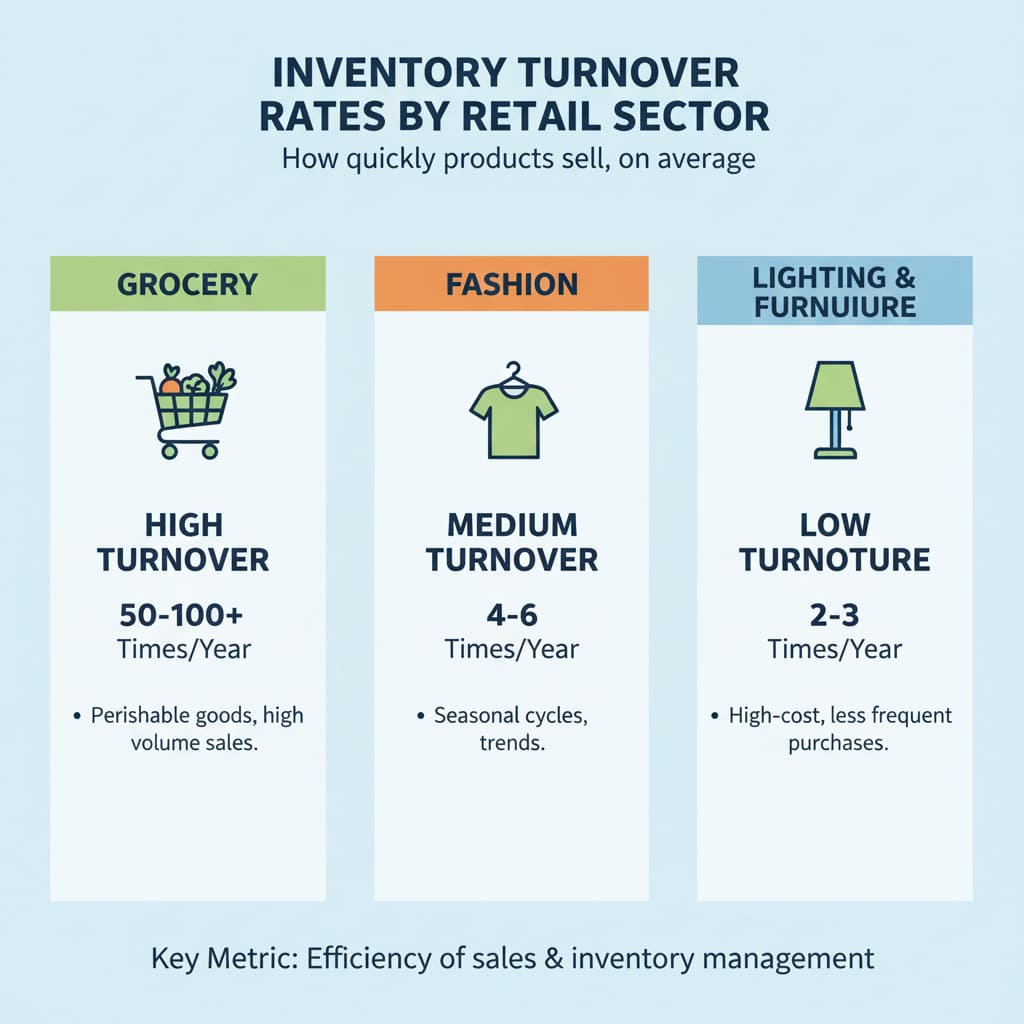

This isn’t a one-size-fits-all number. A grocery store selling perishable milk will have a much higher turnover rate than a jewelry store selling expensive diamonds. For a decorative lighting store, a healthy, achievable goal is typically in the 2.5 to 4.0 range. If your number is below 2.0, it’s a major red flag that you likely have a dead stock problem. If it’s above 4.0, you’re running a very efficient operation!

The Cure – A Step-by-Step Plan to Liquidate Dead Stock Now

Okay, the diagnosis is in. You have some dead stock. Don’t panic. The worst thing you can do is ignore it. The best thing you can do is take decisive, emotionless action. Here is your step-by-step playbook to turn that dead stock back into cash.

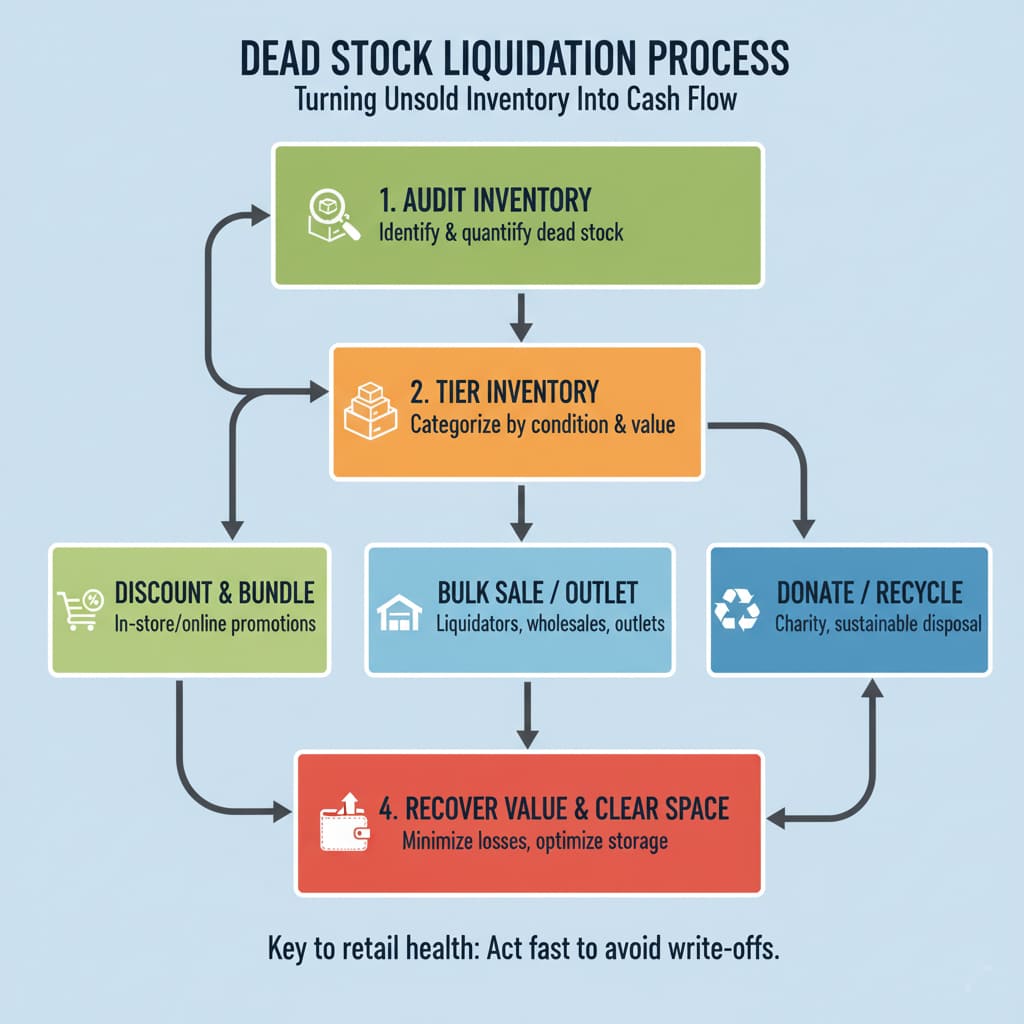

Step 1: The Ruthless Audit – Identify Every Underperformer

You have to be a surgeon here. Go into your point-of-sale (POS) system and run a sales report for the last 12 months. Export it to a spreadsheet. Any product (or SKU) with zero sales is your Dead Stock Priority 1. Any SKU with only one or two sales is Priority 2. This data is your map. It takes the guesswork out of the equation and tells you exactly where the problems are.

Step 2: Tier Your Dead Stock by Potential Value

Not all dead stock is created equal. Before you start slashing prices, categorize your problem inventory into three simple tiers:

- Tier A (High Potential): These are good products that, for some reason, just didn’t connect. Maybe it’s a great lamp in an unpopular color, or it was slightly overpriced. These items still have a chance to be sold without a massive loss.

- Tier B (Medium Potential): These are likely outdated styles or very niche items. They have some value, but you will need to offer a steep discount to find a buyer.

- Tier C (No Potential): This is the truly unsellable stuff. It might be damaged, functionally obsolete, or just plain ugly. The goal here is not to make a profit, but to liquidate it for any amount of cash, or even a tax benefit.

Step 3: Choose Your Liquidation Strategy (From Most to Least Profitable)

Now you can apply the right strategy to the right tier. Work your way down this list:

| Strategy | Description | Best For | Profit Potential |

|---|---|---|---|

| The Creative Bundle | Package a slow-mover with a bestseller for a single, attractive price. | Tier A | High |

| The Flash Sale | A high-urgency, deep-discount sale (40-60% off) for a very limited time. | Tier B | Medium |

| The Employee Sale | Offer the items to your staff at or near your cost. It’s a great perk for them and an easy clear-out for you. | Tier B & C | Low / Break-Even |

| The Charitable Donation | Donate the items to a non-profit like Habitat for Humanity’s ReStore. You get a valuable tax write-off. | Tier C | Loss (but with tax benefit) |

| The Liquidation Company | Sell the remaining items in bulk to a professional liquidator. You’ll only get pennies on the dollar. | The Absolute Last Resort | Heavy Loss |

The Vaccine – Proactive Strategies to Prevent Dead Stock

Clearing out old stock is like performing surgery. It’s necessary, but painful. The real goal is to build a healthy system so you don’t get sick in the first place. Prevention is the key to long-term inventory health.

The #1 Cause of Dead Stock: High-MOQ Purchasing

“The moment you buy it is the moment you own the risk.”

Let’s be very clear: the single biggest cause of dead stock for independent retailers is being forced to buy in high volumes. When a supplier’s Minimum Order Quantity (MOQ) forces you to buy 500 units of a single product, the probability of creating a massive amount of dead stock is incredibly high. You are making a huge financial bet. The solution is to change the game. This is why understanding your purchasing terms is non-negotiable for a healthy business. Master this foundational concept in our definitive guide to MOQ. The key is to find a partner whose business model is actually designed for your success. Explore the transformative power of a flexible supplier in our guide to the benefits of a Low-MOQ partnership.

Embrace Data-Driven Merchandising: Trust the Numbers, Not Your Gut

Your personal taste is important for setting the style of your store, but it should not be the primary factor in your buying decisions. Your own sales data is the most valuable resource you have. The 80/20 Rule, a concept well-documented in business literature by sources like Forbes, is incredibly powerful here. It states that, in many cases, 80% of your results will come from 20% of your efforts. For retail, this means about 80% of your sales will come from about 20% of your products. Your job is to identify that winning 20% and reinvest your capital there, not on speculative long shots.

The “Test and Reorder” Model: Your Secret Weapon

This is the core of an agile and modern inventory strategy. Instead of taking a huge gamble on a new product, you use a low-MOQ partner to bring in a small “test batch.” Just a handful of units. You put them on the floor and see what happens. If they sell out quickly, you’ve found a winner and can confidently place a larger reorder. If they don’t, you’ve gained valuable market insight at a minimal cost. This model is only possible if you have a fast, reliable supply chain. Learn more about how a US-based warehouse enables this powerful strategy.

Implement a Formal “End-of-Life” (EOL) Policy

This is a professional tactic that takes the emotion out of inventory management. Create a simple, formal rule for your business. For example: “Any product that has not sold a single unit in six months is automatically moved to the clearance section at a 30% discount. If it is still unsold after nine months, it moves to a 50% discount.” This creates a systematic process for clearing out slow-movers before they become true dead stock, and it forces you to make unemotional, data-driven decisions.

The Optimization Engine – How to Maximize Inventory Turnover

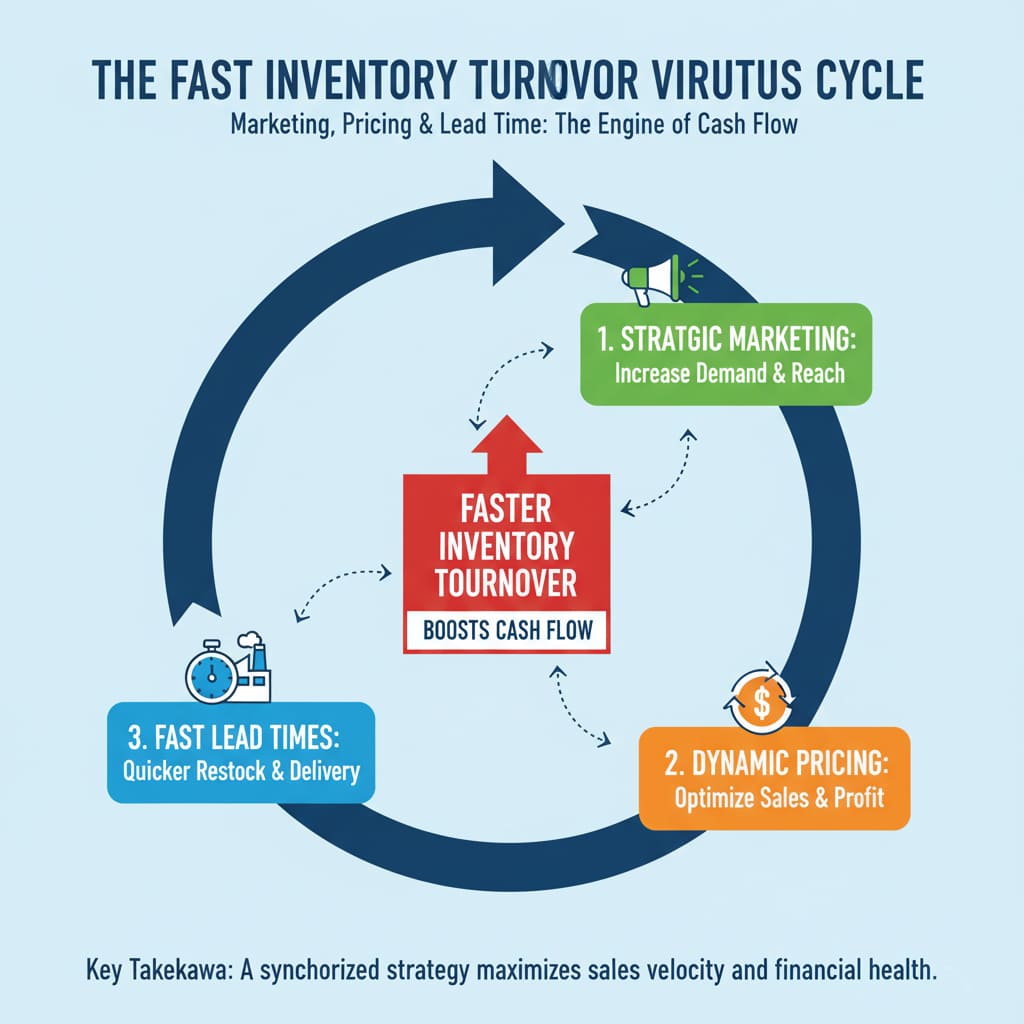

Preventing dead stock is about defense. Maximizing inventory turnover is about offense. It’s about making your good, healthy inventory sell through even faster, which generates more cash and more profit.

The Key Levers for Increasing Your Inventory Turnover Rate

| Lever | Actionable Strategy | Why It Works |

|---|---|---|

| 1. Improve Sales Velocity | Run targeted marketing campaigns and train staff on upselling. | Faster sales directly lead to a higher turnover rate. The math is simple. |

| 2. Shorten Lead Times | Partner with a supplier who has a US-based warehouse. | Reduces the time inventory spends “in transit,” shortening the overall cycle. |

| 3. Optimize Pricing | Use strategic promotions and seasonal sales to boost demand for specific categories. | The right price at the right time can dramatically accelerate sales. |

Your marketing has a direct impact on your inventory health. Creating demand on social media or designing an unforgettable in-store experience are key turnover strategies. Likewise, your choice of supplier is critical. A domestic partner can cut your lead time by over 90% compared to an international one, which has a massive positive effect on your turnover rate. Finally, don’t underestimate the power of a smart sale. Learn how to use pricing as a tool in our complete guide.

The Big Picture – How Inventory Efficiency Fuels Your Entire Business

This isn’t just an operational exercise. Your inventory efficiency is directly linked to the financial health and strategic potential of your entire business.

The Vicious Cycle vs. The Virtuous Cycle

Every retailer finds themselves in one of two cycles:

The Vicious Cycle: A high-MOQ purchase leads to excess inventory. That inventory becomes dead stock, which slows your overall turnover rate. This ties up your precious cash flow, which prevents you from investing in new, winning products. The cycle repeats.

The Virtuous Cycle: A low-MOQ purchase leads to a lean, healthy inventory. This prevents dead stock and speeds up your turnover rate. This frees up cash flow, which allows you to reinvest in proven bestsellers and test exciting new trends. The cycle repeats, and your business grows stronger.

Your inventory strategy determines which cycle you are in.

Tying It All Back to Financial Health

Let’s make the connection crystal clear. Your inventory metrics are not just numbers on a report; they are a direct predictor of your financial performance.

| Inventory Metric | Impact on Cash Flow | Impact on Profitability | Impact on Business Risk |

|---|---|---|---|

| High Dead Stock | Negative | Negative | High |

| Low Inventory Turnover | Negative | Low | Medium |

| High Inventory Turnover | Positive | High | Low |

Ultimately, this is all about building a financially sound and resilient business. Get the complete picture in our masterclass on Cash Flow Management 101 for Independent Retailers.

Conclusion: Your Inventory Should Be a River, Not a Pond

The single most powerful mindset shift you can make as a retailer is to think of your inventory as a flowing river, not a stagnant pond. The goal is to keep it moving. A healthy river is constantly being fed by fresh sources and flowing out to its destination. A stagnant pond just sits, collecting algae and losing life.

By ruthlessly eliminating the dead stock that’s damming your flow and by strategically maximizing your inventory turnover, you can transform your inventory from a source of constant stress into a powerful engine of profit. This isn’t just a tedious accounting task; it is the most proactive strategy you can deploy to build a healthier, more resilient, and more exciting retail business.

Ready to Get Your Inventory Flowing?

It all begins with a supply chain built for speed and efficiency. Discover how Lighting Depot USA’s low-MOQ, fast-replenishment model can help you build a leaner, healthier, and more profitable business today.

Now that you’ve mastered the art of inventory efficiency, integrate this skill into your complete business plan. Return to our ultimate guide for independent lighting retailers to connect all the pieces.

About LightingDepotUSA

The LightingDepotUSA Editorial Team specializes in wholesale lighting trends, showroom strategies, and supply chain solutions tailored for independent retailers across the U.S. With years of experience in both manufacturing and distribution, we provide practical insights to help small businesses grow, reduce costs, and stay competitive.

View all posts by LightingDepotUSA