The Hidden Costs of Sourcing Lighting Directly from Overseas Factories

The email lands in your inbox. It’s a price list from an overseas factory, and the per-unit cost for a beautiful chandelier is 40% less than you’re paying now. Your mind starts racing. The potential profit seems astronomical. This, you think, is the secret to getting ahead.

But is it? That low price is not a complete picture. In fact, it’s not even close. It’s the tip of a massive financial iceberg, and what’s hidden below the surface—the fees, the risks, the delays, and the stress—can easily sink a thriving independent retail business.

This guide is a brutally honest, line-by-line forensic accounting of the true cost of direct importing. We will provide a complete checklist of every tangible fee, intangible cost, and strategic risk you will encounter. By the end, you will be able to make a fully informed decision, armed with facts, not fantasy. This deep dive into sourcing is a crucial part of the overall business framework we present in our ultimate guide for independent lighting retailers.

Table of Contents

The Hidden Costs Before You Even Place the Order

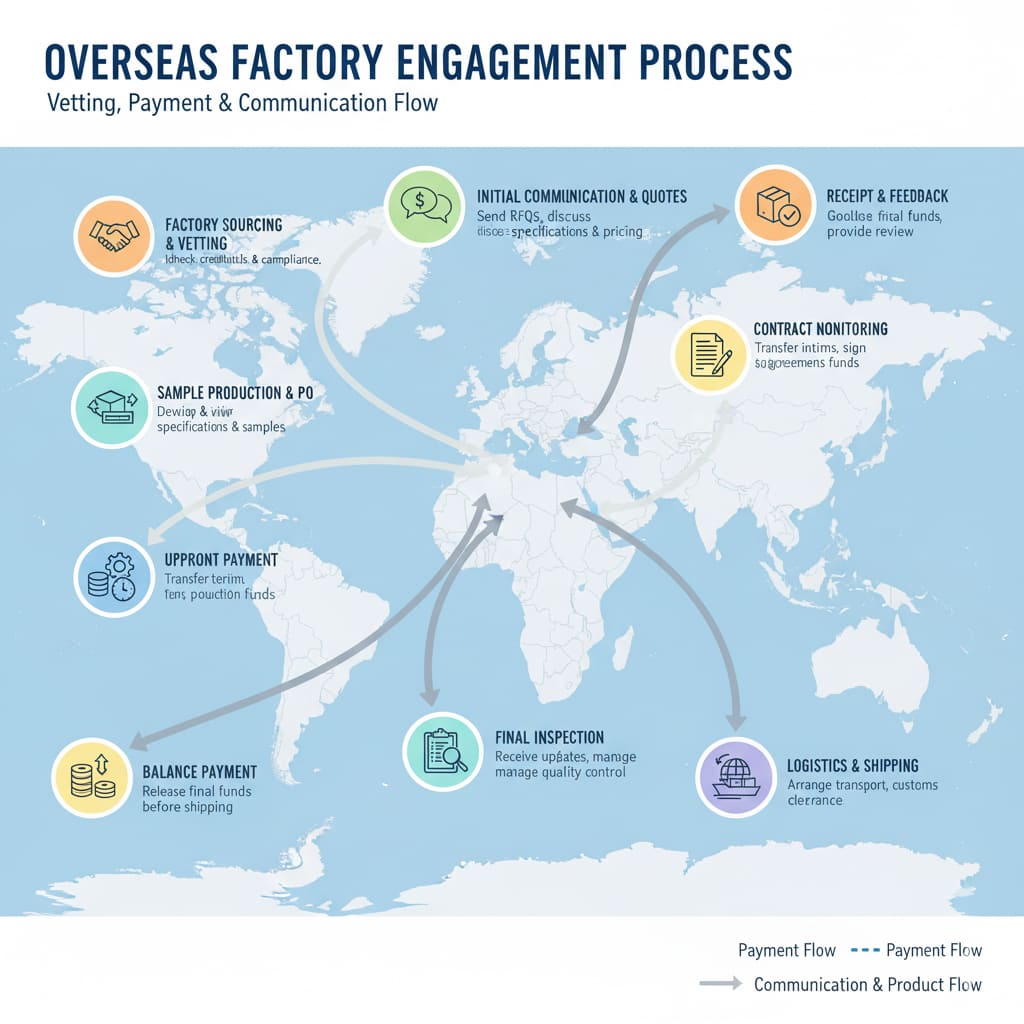

The expenses begin long before you commit a single dollar to inventory. The process of finding a reliable international partner is a significant, and often completely overlooked, business cost in itself.

The Cost of Finding and Vetting a Reliable Factory

Finding a trustworthy factory overseas is not a simple Google search; it’s a part-time job that requires immense effort and carries significant risk. The costs include:

- Your Time: Expect to spend dozens of hours sifting through platforms like Alibaba, sending countless emails, and attempting to verify the legitimacy of potential suppliers. Every hour you spend doing this is an hour you aren’t spending with customers.

- Auditing & Sourcing Agents: To truly vet a factory, many businesses hire a third-party auditing service or a local sourcing agent. These professional services are essential for due diligence but can cost hundreds or even thousands of dollars before you’ve even placed an order.

- Travel Expenses: For any significant commitment, a personal visit to the factory is often necessary to build a relationship and verify their capabilities. This means expensive international flights, hotels, and time away from your store.

The Cost of Communication and Cultural Barriers

Coordinating with a team that is 12 time zones away is a constant source of friction. A simple question can take 24 hours to get an answer. Misunderstandings due to language barriers can lead to costly mistakes in product specifications. Business norms can also differ significantly, leading to frustration and confusion. This constant communication friction is a real, albeit unquantifiable, cost to your efficiency and peace of mind.

The Cost and Risk of International Payments

You can’t just use a credit card. International sourcing requires wire transfers, which come with their own costs and risks. Banks typically charge a fee of $50 or more for each international transfer. More importantly, you will almost always be required to pay a large deposit—typically 30% to 50% of the total order value—upfront. This payment comes with significant risk. There is very little recourse if a fraudulent “supplier” simply disappears after receiving your funds.

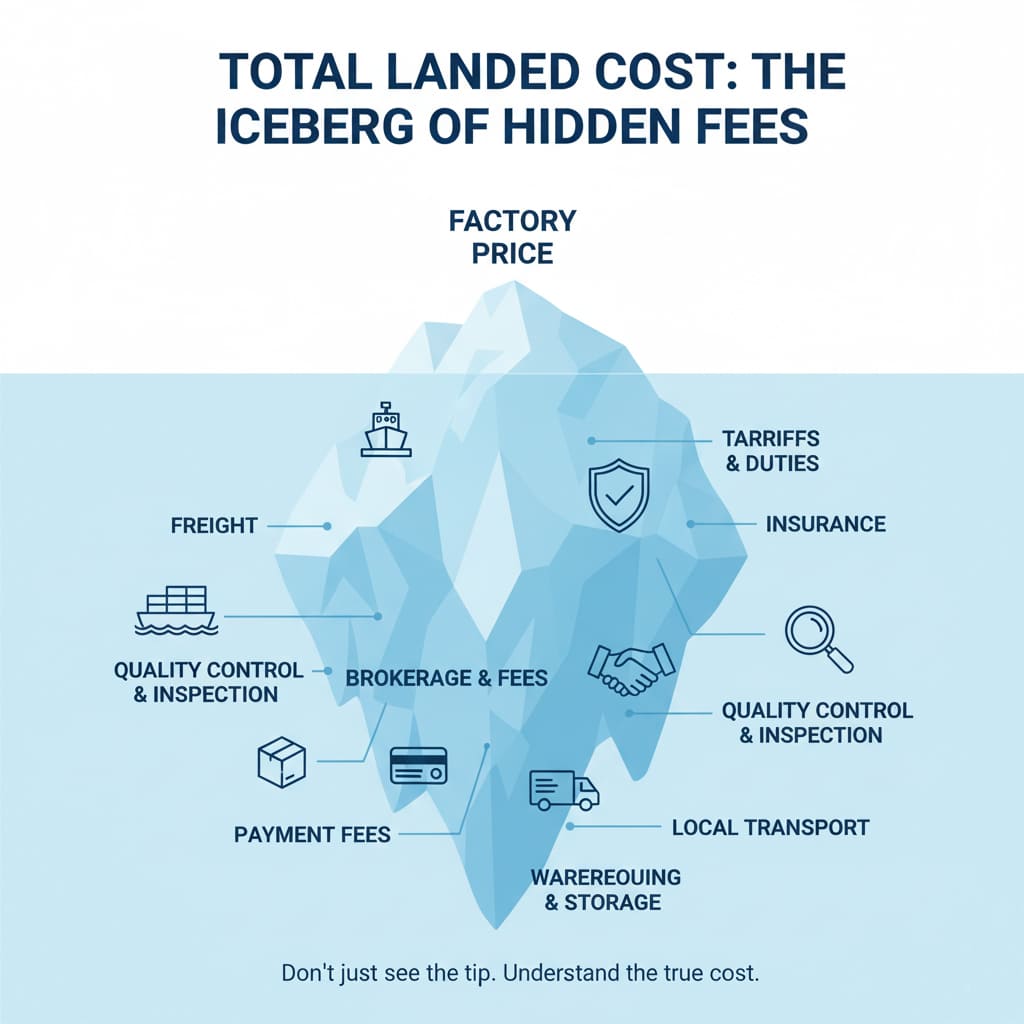

The Hard Costs – Deconstructing the Financial Iceberg

This is where we get into the nitty-gritty. Let’s break down every single tangible fee that stands between that low factory price and the actual cost of getting the product to your door.

Part 1: The Shipping & Freight Labyrinth

Getting your product from a factory in Asia to your showroom in America is a long, complex, and expensive journey. It’s crucial to understand who is responsible for each leg of that journey.

| Shipping Term (Incoterms) | What It Means | Who Pays for What |

|---|---|---|

| EXW (Ex Works) | The factory’s only responsibility is to make the product available at their door. | You pay for everything: trucking in the origin country, ocean freight, insurance, customs, and final delivery. |

| FOB (Free On Board) | The factory is responsible for getting the goods to the origin shipping port and loaded onto the ship. | You pay for: the ocean freight, insurance, customs, and final delivery. This is more common, but still leaves you with most of the cost and complexity. |

Regardless of the terms, you, the importer, will be paying for the most expensive parts of the journey, including volatile ocean freight costs and mandatory marine insurance.

Part 2: The Government’s Share – Import Duties, Tariffs, and Taxes

Once your goods arrive at a US port, the government requires its share. This is a complex and mandatory part of the importing process. According to the U.S. Customs and Border Protection (CBP), the importer is legally responsible for these payments.

- Import Duties: This is a base tax calculated as a percentage of your goods’ value, determined by their classification in the Harmonized Tariff Schedule (HTS).

- Punitive Tariffs: These are additional, often large, tariffs placed on specific goods from specific countries due to trade policy (like the Section 301 tariffs on many goods from China). These can increase your costs by 25% or more overnight.

- Mandatory Fees: You will also pay the Merchandise Processing Fee (MPF) and the Harbor Maintenance Fee (HMF) on every shipment.

Part 3: The “Paperwork” Costs – Customs & Brokerage

You cannot simply show up at the port and pick up your container. Your shipment must be formally “entered” and cleared by US Customs. This requires a licensed professional.

- The Customs Broker: You will need to hire a licensed customs broker to prepare and file the complex customs entry documentation on your behalf.

- Brokerage Fees: You will pay your broker a fee for their services, which varies depending on the complexity of your shipment.

- Customs Bond: You are required to purchase a customs bond, which is essentially an insurance policy for the government that guarantees all duties and taxes will be paid.

The Bottom Line: Calculating Your True Landed Cost

The “True Landed Cost” is the most important number you will ever calculate. It is the final, all-in cost per unit. Here is the formula:

(Total Product Cost + Total Shipping & Fees + Total Tariffs & Duties) / Number of Good Units = True Landed Cost per Unit

Let’s see how this plays out in a realistic scenario.

| Cost Component | Direct Import Scenario | Domestic Warehouse Scenario |

|---|---|---|

| Factory / Wholesale Price | $50.00 | $68.00 |

| International Freight, Insurance & Fees (Prorated) | +$12.00 | Included |

| Tariffs & Duties (Prorated, e.g., 25%) | +$12.50 | Included |

| Customs Brokerage (Prorated) | +$2.50 | Included |

| True Landed Cost | $77.00 | $68.00 |

In this common scenario, the “cheaper” factory price ends up being over 13% more expensive by the time it reaches your door. And this doesn’t even account for the cost of your time or the capital you’ve had tied up for four months. This ties directly into your store’s financial health. Learn more in our guide on Cash Flow Management for Independent Retailers.

The “Soft” Costs – The Time and Stress Tax

Not all costs appear on an invoice. The direct import model levies a heavy tax on your most precious resources: your time, your energy, and your focus.

Your New Job: Part-Time International Logistics Manager

When you source directly, you are now in the trucking and shipping business. You are responsible for coordinating with the factory, the freight forwarder, the shipping line, the customs broker, and the final delivery driver. Expect to spend 10 to 15 hours managing the logistics for every single shipment. What is an hour of your time worth? Multiply that by 15, and you’ll see this is a very real, and very high, cost.

The High Cost of Stress and Uncertainty

The waiting and the worrying take a mental toll. Is my container on the right ship? Will it get held up in customs? Will the products inside be what I actually ordered? This constant, low-grade anxiety is a massive distraction that pulls your focus away from the activities that actually grow your business, like marketing and selling.

The Post-Arrival Costs – The Nightmare Scenarios

The container has finally arrived at your store. Congratulations. But don’t breathe a sigh of relief just yet. Some of the biggest and most painful costs can be discovered at this final stage.

The Quality Control Catastrophe: Opening the Container

“The moment of truth for any importer is when they crack open that container door.”

This is where your entire investment is realized, for better or for worse. What if you open the doors and find that 30% of your fixtures are damaged from transit, have cosmetic flaws, or are wired incorrectly? This is a catastrophic, but sadly common, scenario. The cost of sorting the bad product, storing it, and eventually disposing of it is immense. And worse, your per-unit cost for the good product you can actually sell just skyrocketed. This is why a supplier’s own quality control is so vital. Learn what to ask in our guide on How to Vet a Wholesale Lighting Supplier.

The Impossible Return: Damages and Warranties

So what do you do with those defective products? The reality is, returning them to a factory overseas is almost never financially or logistically feasible. The loss is almost always 100% yours to absorb. A good domestic partner, on the other hand, will have a clear and simple process for handling these issues. A supplier’s return policy is a direct measure of their accountability. Learn more in our guide: Why Your Supplier’s Return Policy Matters.

The Sudden Warehouse Problem: Where Do You Put 500 Chandeliers?

The final surprise cost is the physical space. The arrival of a 40-foot container is a major event. Do you have the physical space to store hundreds of large boxes? Do you have the staff and equipment to unload them safely? Many retailers are forced to rent expensive off-site storage units, adding another recurring monthly expense to their balance sheet.

The Strategic & Opportunity Costs

The most profound costs of the direct import model are not the fees you pay, but the opportunities you lose. This model fundamentally limits your ability to grow and adapt.

The Loss of Agility and Speed-to-Market

Being locked into a four-month lead time means you are perpetually behind the curve. You are forced to make buying decisions based on where the market was seasons ago, not where it is today. You cannot react to emerging trends. You cannot quickly restock a bestseller. You cannot adapt to your competitors’ moves. This lack of agility is a massive strategic handicap in the fast-paced world of modern retail.

The Stifling of Product Diversity

Direct importing requires a huge capital investment in a very small number of products. This forces your showroom to become stagnant and boring. The alternative is a low-MOQ model, which allows you to offer a wide and ever-changing catalog that keeps customers coming back. Learn more about the power of a low MOQ in our complete guide.

The Damage to the Customer Experience

Ultimately, a slow, risky, and inflexible supply chain hurts your customer. It leads to stockouts, an inability to fulfill special orders, and a less exciting product selection. Over time, this has a corrosive effect on your brand and your reputation as the best lighting resource in your community.

Conclusion: Look Beyond the Price Tag to See the True Cost

The low factory price is an illusion. The true cost of direct importing is a complex and dangerous equation of hard fees, the soft costs of your time and stress, and the massive strategic cost of lost opportunities. It is a model designed for giant corporations with dedicated logistics departments, not for agile independent retailers.

The smarter choice is to partner with a modern, US-warehoused supplier. This isn’t the “more expensive” option; it is the de-risked, more transparent, and often more profitable option. It’s an investment in simplicity, speed, and the peace of mind that allows you to focus on what you do best: building relationships and selling beautiful lighting.

Ready to Escape the Hidden Costs?

It’s time to partner with a supplier who handles the complexity so you don’t have to. Discover how Lighting Depot USA’s transparent wholesale pricing and US-based warehouse model provide a simpler, safer, and more profitable path to growth.

Now that you understand the true cost of sourcing, build a smarter business model. Integrate this knowledge into your complete strategy by returning to our ultimate guide for independent lighting retailers.

About LightingDepotUSA

The LightingDepotUSA Editorial Team specializes in wholesale lighting trends, showroom strategies, and supply chain solutions tailored for independent retailers across the U.S. With years of experience in both manufacturing and distribution, we provide practical insights to help small businesses grow, reduce costs, and stay competitive.

View all posts by LightingDepotUSA