Cash Flow Management 101: A Survival Guide for Independent Retailers

The end of the month is coming. You look at your sales report, and it was a good month! You sold plenty of beautiful fixtures. But then you look at your bank account, and a knot forms in your stomach. After paying rent, payroll, and your supplier invoices, there’s almost nothing left. How can you be so busy, yet feel so broke?

This is the retailer’s paradox. It’s a stressful and all-too-common situation that comes from a misunderstanding of the most critical metric in your business: cash flow. It is not the same as profit, and confusing the two is one of the most dangerous mistakes a business owner can make.

This guide will demystify cash flow completely. We will provide you with a simple, step-by-step framework to understand, measure, and, most importantly, *control* the flow of money in your business. This isn’t a dry accounting lesson; it is a practical guide to gaining financial control and peace of mind. Mastering your finances is the first and most important pillar of a successful business, a foundational concept we introduce in our ultimate guide for independent lighting retailers.

Table of Contents

The Basics – What is Cash Flow, Really?

Before you can fix a problem, you need to understand it. So let’s break down cash flow into simple, clear terms. No jargon. No complex accounting. Just the fundamentals you need to know.

The Bucket Analogy: Your Simplest Visual

Imagine your business is a large bucket.

- Cash Inflows: Every time you make a sale, money pours into the bucket. This is your revenue.

- Cash Outflows: Every time you pay a bill—rent, inventory, salaries—a hole opens up and water drains out. These are your expenses.

Your **net cash flow** is simply the final result at the end of the month: is the water level in the bucket higher or lower than when you started? If it’s higher, you have positive cash flow. If it’s lower, you have negative cash flow. Simple as that.

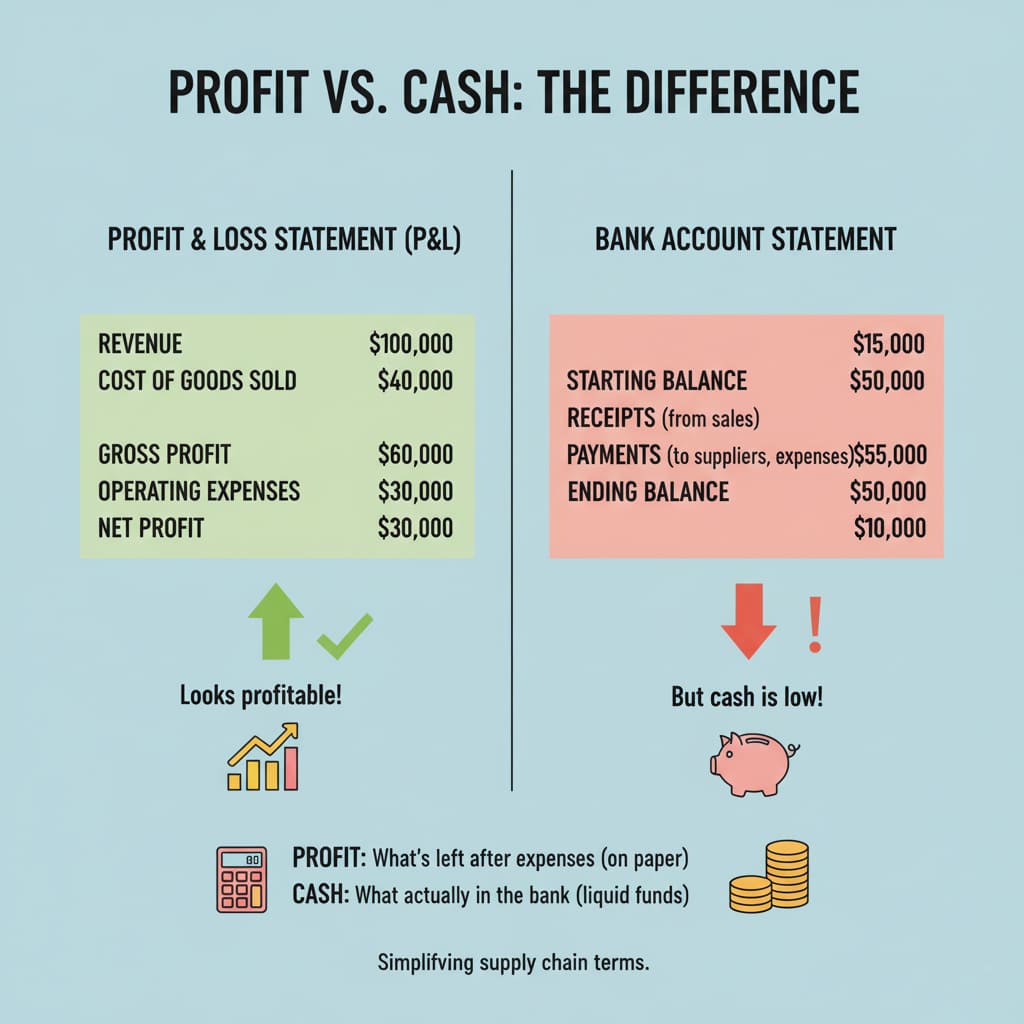

The Golden Rule of Business: Profit is an Opinion, Cash is a Fact

This is the most critical distinction in all of business. “Profit” is an accounting concept. It can look great on paper. For example, you can make a profitable $5,000 sale to an interior designer and send them an invoice. On your profit and loss statement, you’ve made money! But until that designer actually pays the invoice, you have zero cash in the bank from that sale. You can’t pay your rent with a profit statement. You can only pay it with cash.

| Factor | Profit | Cash Flow |

|---|---|---|

| What It Is | An accounting calculation (Revenue – Expenses) | The actual money moving in and out of your bank |

| What It Measures | Long-term viability and business health | Short-term survival and operational ability |

| The Bottom Line | Tells you if your business *should* be successful. | Tells you if your business can *survive* until next month. |

Your Financial Dashboard – How to Calculate and Understand Your Cash Flow

You can’t manage what you don’t measure. Creating a simple cash flow statement is not as intimidating as it sounds. It’s your financial dashboard, giving you a clear view of where your money is going and where it’s coming from.

How to Create a Simple Cash Flow Statement

You don’t need to be an accountant to do this. You can use a simple spreadsheet. Here is a template you can adapt for your own business. The goal is to track this every single month.

| Simple Monthly Cash Flow Statement Template | |

|---|---|

| Beginning Cash Balance (Start of Month) | |

| Cash Inflows (Money Coming In) | |

| Cash & Credit Card Sales | $ _________ |

| Invoice Payments Received | $ _________ |

| Total Cash Inflows | $ _________ |

| Cash Outflows (Money Going Out) | |

| Inventory Purchases (COGS) | $ _________ |

| Rent or Mortgage | $ _________ |

| Payroll & Commissions | $ _________ |

| Utilities (Electric, Internet, etc.) | $ _________ |

| Marketing & Advertising | $ _________ |

| Loan Payments & Other Debt | $ _________ |

| Total Cash Outflows | $ _________ |

| Net Cash Flow (Inflows – Outflows) | |

| Ending Cash Balance (End of Month) | |

The Investigation – What are the Top 5 Cash Flow Killers for Retailers?

If your cash flow is consistently negative, it’s not bad luck; it’s a symptom of a deeper problem. Let’s play detective and identify the most common culprits that drain a retailer’s bank account.

Cash Flow Killer #1: Too Much Capital Tied Up in Inventory

This is, without a doubt, the number one cash flow killer for any business that sells physical products. Every dollar’s worth of unsold inventory sitting in your backroom is a dollar you can’t use for anything else. This problem is usually caused by two things:

- High Minimum Order Quantities (MOQs): When a supplier forces you to buy hundreds of units of a single product, they are forcing you to drain your cash reserves on a massive, risky bet. This is why finding a flexible, low-MOQ partner is so critical. Learn how to break free from this trap in our definitive guide to MOQ.

- Slow-Moving or “Dead” Stock: This is inventory that you’ve already paid for, but it just isn’t selling. It’s the financial equivalent of a boat anchor. Learning how to identify and liquidate this stock is essential. Get our expert strategies for turning that old stock back into cash.

The goal is to run a leaner, more efficient operation. Learn how to calculate the perfect inventory level for your store in our guide.

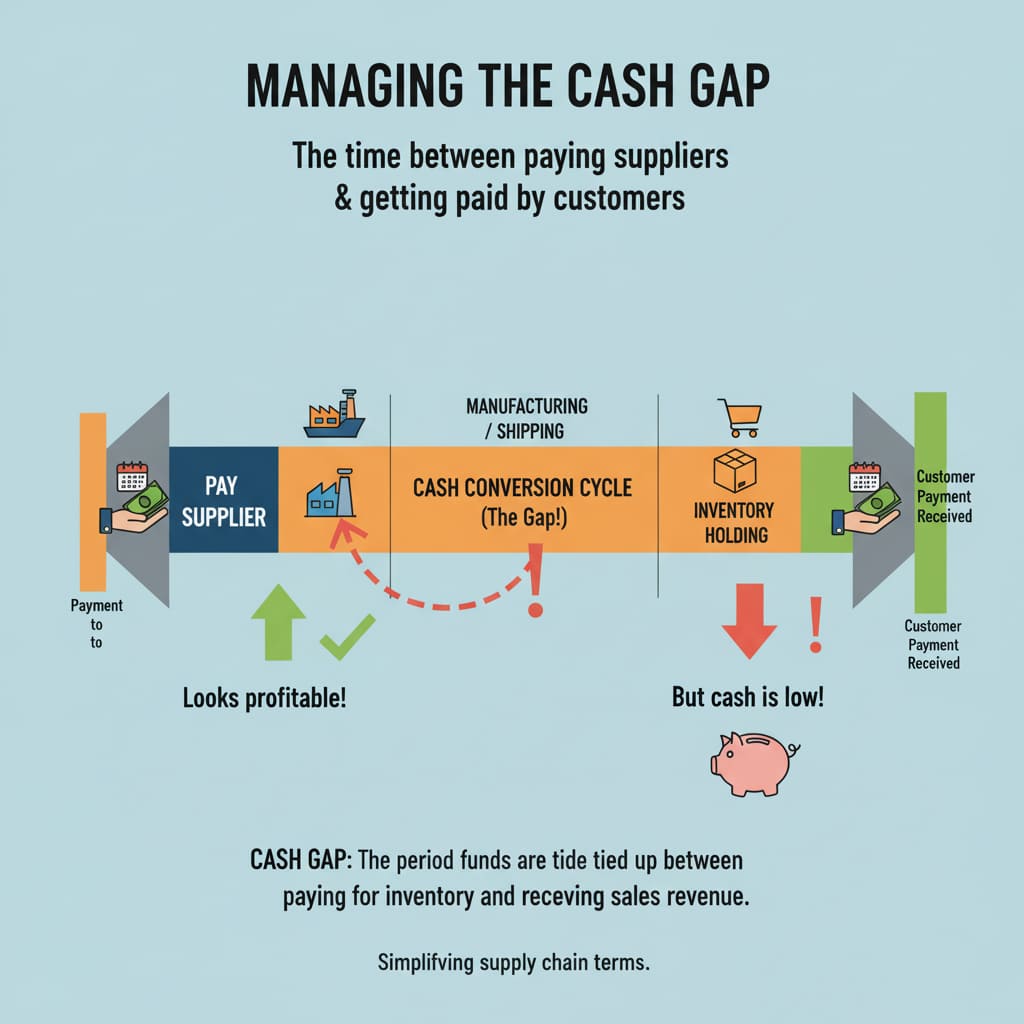

Cash Flow Killer #2: Unfavorable Payment Terms (Both Ways)

The timing of payments can have a massive impact on your cash flow. If you are forced to pay your suppliers the moment you place an order (COD or “Cash on Delivery”), but you allow your own trade customers (like designers) 30 or 60 days to pay you, you create a dangerous “cash gap.” You have paid for the product long before you receive the cash from its sale. Smart retailers work hard to get “Net 30” terms from their suppliers while ensuring their own customers pay promptly.

Cash Flow Killer #3: Poor Pricing and Low Profit Margins

If your profit margins are too thin, you can find yourself in a situation where you are very busy but still losing money. If a $100 sale only generates $20 of gross profit, you have to sell a huge volume of products just to cover your basic operating expenses like rent and payroll. This is a recipe for a cash flow crunch. A robust pricing strategy is not just a “nice-to-have”; it’s a necessity for survival. Your pricing is your most powerful profit lever. Learn how to master it in our pricing strategy guide.

The Playbook – Actionable Strategies to Improve Your Cash Flow Today

Okay, enough theory. Let’s get practical. Improving your cash flow comes down to three things: getting more cash in, letting less cash out, and speeding up the whole process. Here are actionable strategies for each.

Part A: How Can I Increase My Cash Inflows?

- Focus on High-Margin Products: Run promotions and train your staff to highlight the products that generate the most profit for your store.

- Upsell and Cross-Sell: Never just sell one item when you can solve a whole room’s problem. A customer buying a chandelier might also need matching sconces and a dimmer switch. This is about providing better service and increasing the average transaction value. Learn the simple techniques to master this skill.

- Court High-Value Customers: Actively build relationships with interior designers, contractors, and builders. Their projects are larger and they bring repeat business. Learn how to build a lucrative professional network with our guide.

- Add a Service Revenue Stream: Offer paid in-home lighting design consultations. This brings in high-margin revenue that doesn’t require any inventory.

Part B: How Can I Decrease My Cash Outflows?

“A penny saved is a penny earned.” – Benjamin Franklin. This is the mantra of a cash flow champion.

- Revolutionize Your Inventory Purchasing: This is the single biggest lever you can pull. By shifting from a high-risk, high-MOQ supplier to a low-risk, low-MOQ partner, you can dramatically reduce the single largest expense in your business. Explore the transformative benefits of this modern approach.

- Conduct an Expense Audit: Once a quarter, print out your bank and credit card statements and go through them line by line. Are you paying for software subscriptions you no longer use? Can you find a better insurance rate? Small savings add up to big results.

- Negotiate with Suppliers: Don’t be afraid to ask your key partners for better terms. Can they offer Net 30 payment terms to ease your cash flow? Is there a discount for paying early? A good partner will be willing to work with you. This is a key part of the supplier vetting process. Learn what to look for in a great partner.

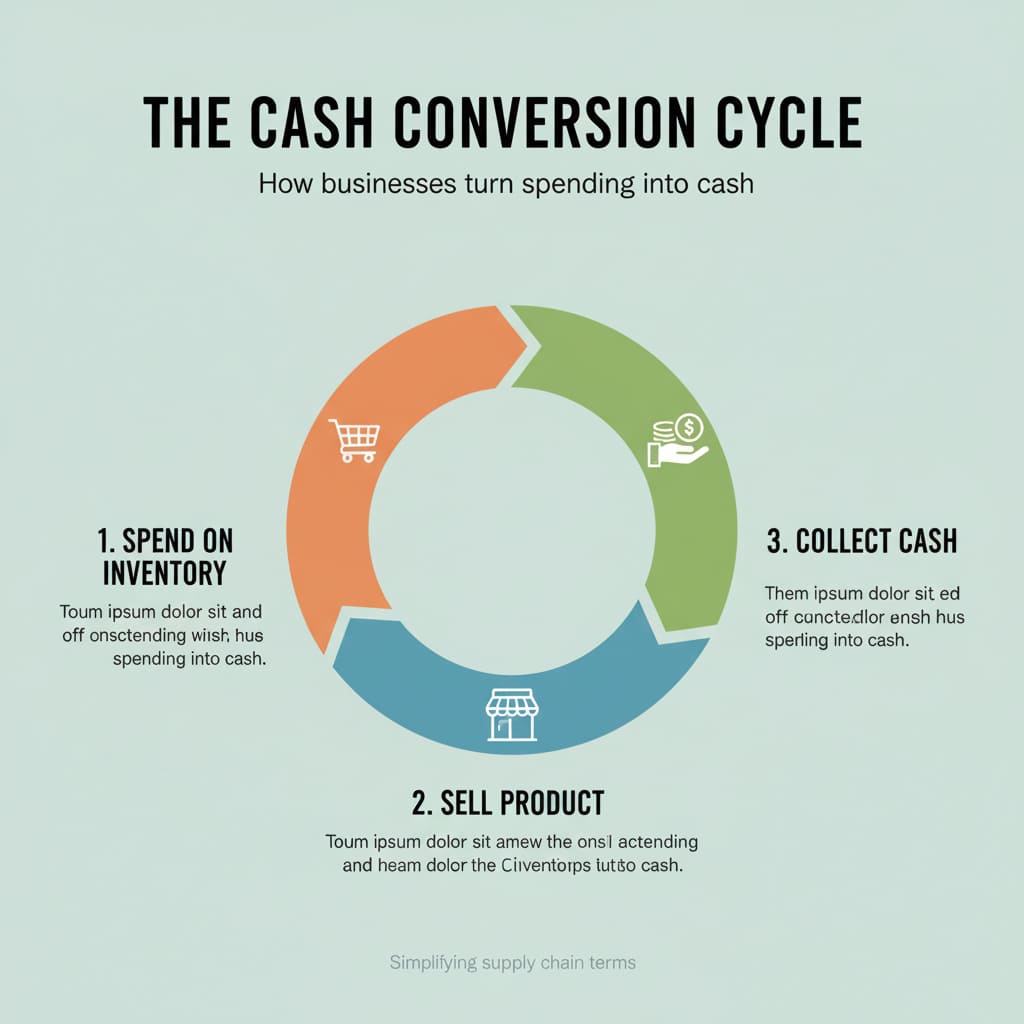

Part C: How Can I Accelerate My Cash Conversion Cycle?

The “Cash Conversion Cycle” is a fancy term for a simple idea: How long does it take from the moment you spend a dollar on inventory to the moment you get that dollar back from a customer sale? Your goal is to make this cycle as short as possible.

| Strategy | How It Shortens the Cycle | Impact |

|---|---|---|

| Require Deposits on Special Orders | You get cash upfront, before you have to purchase the inventory. | High |

| Offer a Discount for Early Invoice Payment | Incentivizes your trade customers to pay you faster. | High |

| Improve In-Store Experience | A great experience leads to faster purchasing decisions and moves inventory off your floor. | Medium |

| Partner with a US-Warehouse Supplier | You can buy inventory closer to the time of sale, dramatically shortening the “inventory holding” period. | Very High |

Improving your in-store experience can also play a surprising role by encouraging faster purchasing decisions.

Looking Ahead – How to Forecast and Plan Your Cash Flow

Managing your cash flow shouldn’t be a reactive, stressful scramble at the end of each month. With a little planning, you can move to a proactive, confident approach. A cash flow forecast is your financial roadmap for the future.

How to Create a 12-Month Cash Flow Forecast

This is simpler than it sounds. Using the same statement template from before, you’re just going to project the numbers for the next 12 months.

- Forecast Your Sales: Be realistic. Use your sales data from last year as a baseline. Adjust for any known factors, like a planned marketing campaign or local economic trends. Account for the natural seasonality of your business.

- Map Out Your Expenses: Start with your fixed costs that don’t change month to month (rent, salaries, insurance). Then, estimate your variable costs based on your sales forecast (inventory purchases, commissions, shipping).

- Analyze the Scenarios: Create three versions of your forecast: a realistic “base case,” an optimistic “best case” (e.g., sales are 20% higher), and a pessimistic “worst case” (e.g., sales are 20% lower). This “stress testing,” as financial experts at institutions like the Stanford Graduate School of Business recommend, is how you prepare for the unexpected and ensure you always have a plan.

Tools, Resources, and Final Thoughts

You don’t have to do this alone. There are fantastic tools available to help you manage your finances with ease and confidence.

What Are the Best Tools for Managing Cash Flow?

- For Simple Tracking: A well-designed spreadsheet in Google Sheets or Microsoft Excel is a powerful and free tool that is perfect for many small businesses.

- For Growing Businesses: User-friendly accounting software like QuickBooks Online or Xero can automate much of this process. They link directly to your bank accounts and can generate cash flow statements with a few clicks.

- For Proactive Planning: Dedicated cash flow forecasting tools like Float or Jirav can provide even deeper insights and help you run complex scenarios as your business grows.

The 5 Most Common Cash Flow Mistakes Retailers Make

Avoid these common pitfalls:

- Confusing Profit with Cash: The #1 mistake. Remember, you can’t pay bills with paper profits.

- Over-investing in Inventory: Tying up too much cash in slow-moving or speculative stock.

- Having No Cash Reserve: Failing to keep a buffer (typically 3-6 months of operating expenses) for emergencies.

- Being a Bank for Your Customers: Having lenient and poorly managed accounts receivable.

- Flying Blind: Failing to review your financial statements on a regular, monthly basis.

From Cash Flow Anxiety to Financial Control

Cash flow is not a complex, scary accounting term. It is the simple, real-time pulse of your business. It’s the story of money in, money out. By understanding it, measuring it consistently, and applying the strategies in this guide, you can take control of that story.

This is more than just good bookkeeping. It is the key to reducing stress, making confident decisions, and building a resilient, profitable, and enjoyable business. It’s the key to sleeping well at night.

Ready to Build a Healthier Financial Future?

It all starts with a smarter inventory strategy. Discover how Lighting Depot USA’s low-MOQ, US-based warehouse model is designed to improve your cash flow from day one.

Now that you’ve mastered your finances, integrate this knowledge into your complete plan for growth. Return to our ultimate guide for independent lighting retailers to build your comprehensive business strategy.

About LightingDepotUSA

The LightingDepotUSA Editorial Team specializes in wholesale lighting trends, showroom strategies, and supply chain solutions tailored for independent retailers across the U.S. With years of experience in both manufacturing and distribution, we provide practical insights to help small businesses grow, reduce costs, and stay competitive.

View all posts by LightingDepotUSA